The Unified Pension Scheme (UPS) is a transformative initiative by the Indian government, set to replace the National Pension System (NPS) for central government employees. Scheduled for implementation on April 1, 2025, UPS combines the best features of the Old Pension Scheme (OPS) and NPS to provide a guaranteed, inflation-adjusted pension.

This scheme ensures financial security for retirees while addressing long-standing demands for a more robust pension framework.

With the announcement of the 8th Pay Commission, which is expected to be implemented by January 1, 2026, central government employees and pensioners are anticipating significant changes in their pensions. The UPS guarantees a minimum pension amount and includes provisions for family pensions and inflation adjustments.

Key Features of the Unified Pension Scheme

- Guaranteed Pension: Employees will receive 50% of their average basic pay from the last 12 months before retirement, provided they complete at least 25 years of service.

- Minimum Pension: A minimum pension of ₹10,000 per month is assured for those with at least 10 years of service.

- Family Pension: In case of a pensioner’s demise, their family will receive 60% of the last drawn pension.

- Inflation Indexation: Pensions will be adjusted based on the All India Consumer Price Index for Industrial Workers (AICPI-IW).

- Pro-rata Pension: Employees with less than 25 years of service will receive a proportionate pension.

- Lump-Sum Payment: At superannuation, employees will also receive a lump-sum amount equivalent to 1/10th of their monthly emoluments for every six months of service.

Impact of the 8th Pay Commission on UPS

The 8th Pay Commission, approved by the Union Cabinet in January 2025, is expected to bring substantial revisions to salaries and pensions for central government employees.

A critical factor in determining these revisions is the fitment factor, which acts as a multiplier to calculate salary and pension hikes.

Projected Fitment Factor and Its Impact

- Under the 7th Pay Commission, a fitment factor of 2.57 was applied.

- For the 8th Pay Commission, experts predict a fitment factor ranging between 1.92 and 2.86.

- If a fitment factor of 2.86 is implemented:

- The minimum salary would increase from ₹18,000 to ₹51,480.

- The minimum pension under UPS would rise from ₹9,000 to approximately ₹25,740.

These projections indicate that pensions could see an increase of up to 186%, depending on final government decisions.

Minimum Pension Under UPS After the 8th Pay Commission

Based on current estimates and expert opinions:

- For employees completing at least 25 years of service, pensions will be calculated as 50% of their average basic pay over the last year.

- Assuming a fitment factor of 2.86, the minimum pension could range between ₹17,280 and ₹25,740 per month.

- Employees with less than 25 years of service will receive pensions on a pro-rata basis but not less than ₹10,000 per month.

This guaranteed structure ensures that retirees maintain financial stability post-retirement while addressing inflation through regular adjustments.

Comparison: UPS vs NPS vs OPS

| Feature | Unified Pension Scheme (UPS) | National Pension System (NPS) | Old Pension Scheme (OPS) |

|---|---|---|---|

| Minimum Pension | ₹10,000 | No fixed minimum | No fixed minimum |

| Guaranteed Pension | Yes (50% of last basic pay) | Market-linked returns | Yes |

| Inflation Adjustment | Yes (linked to AICPI-IW) | No | No |

| Family Pension | Yes (60% of retiree’s pension) | No | Yes |

| Pro-rata Benefit | Yes | No | No |

The UPS stands out as a balanced solution that combines guaranteed benefits with inflation protection.

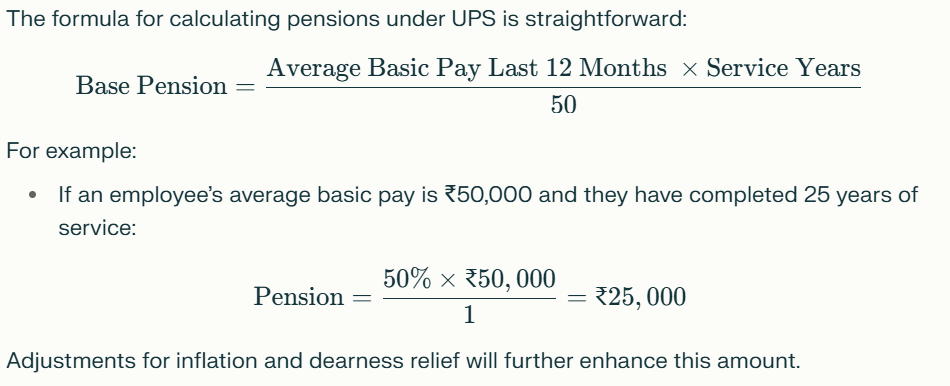

How to Calculate Your Pension Under UPS?

Adjustments for inflation and dearness relief will further enhance this amount.