Udyam Registration is an online process introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in India. It replaces the earlier systems of Udyog Aadhaar Memorandum (UAM) and Entrepreneur Memorandum (EM-II).

This registration provides a unique identity to MSMEs and offers access to various government benefits, schemes, and incentives.

The process is simple, paperless, and entirely self-declaration-based. It eliminates the need for physical documentation, making it easier for businesses to register and avail themselves of the benefits offered under the MSME framework.

Eligibility for Udyam Registration

To register under Udyam, enterprises must meet specific investment and turnover criteria defined under the MSMED Act, 2006.

The classification is as follows:

| Category | Investment in Plant & Machinery or Equipment | Annual Turnover |

|---|---|---|

| Micro Enterprises | Up to ₹1 crore | Up to ₹5 crore |

| Small Enterprises | Up to ₹10 crore | Up to ₹50 crore |

| Medium Enterprises | Up to ₹50 crore | Up to ₹250 crore |

Who Can Register?

- Sole proprietorships

- Partnerships

- Limited Liability Partnerships (LLPs)

- Private limited companies

- Any other legal entity involved in manufacturing, services, wholesale, or retail trade

Documents Required for Udyam Registration

The Udyam registration process is entirely online and requires minimal documentation. Most details are auto-fetched from government databases linked to PAN and GSTIN systems. Below are the key requirements:

- Aadhaar Card: Aadhaar number of the business owner or authorized signatory.

- PAN Card: PAN of the enterprise or proprietor.

- Business Details:

- Name of the enterprise

- Type of organization

- Address of the business unit(s)

- Bank Details: Bank account number and IFSC code.

- Investment & Turnover Information: Data fetched automatically from IT and GST databases.

Note: GST registration is mandatory only for businesses required to register under GST law.

Benefits of Udyam Registration

Registering as an MSME under Udyam offers numerous advantages:

- Access to government subsidies and schemes

- Easier loan approvals with lower interest rates

- Protection against delayed payments

- Eligibility for participation in government tenders

- Concessions on electricity bills and patent fees

Step-by-Step Guide to Udyam Registration

Follow these simple steps to complete your Udyam registration:

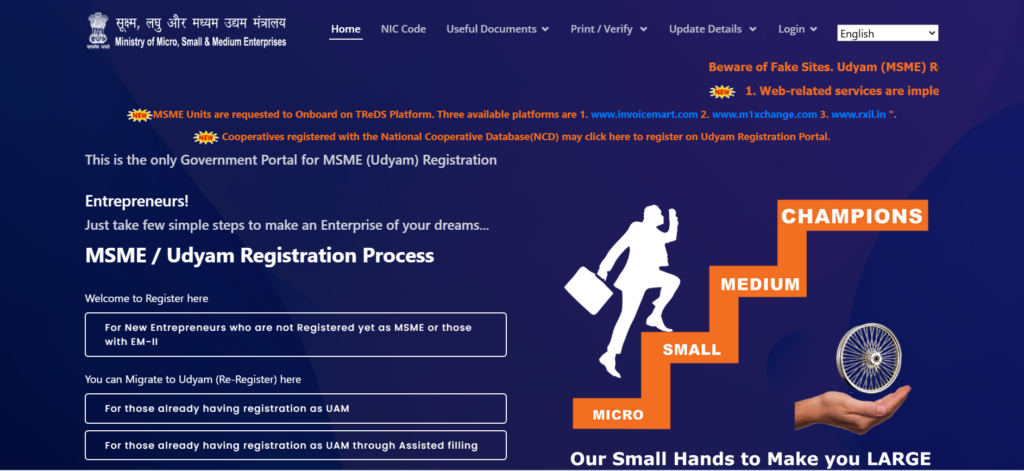

Step 1: Visit the Official Portal

Go to the Udyam Registration portal at udyamregistration.gov.in.

Step 2: Choose Your Category

Select “For new entrepreneurs who are not registered yet as MSME or those with EM-II.”

Step 3: Aadhaar Verification

- Enter your Aadhaar number and name as per your Aadhaar card.

- Validate using OTP sent to your registered mobile number.

Step 4: PAN Verification

- Provide your PAN details.

- Validate them through OTP sent to your registered mobile number.

Step 5: Fill in Business Details

Enter all relevant details about your enterprise:

- Name of enterprise

- Address

- Bank account details

- NIC code (National Industrial Classification code)

- Number of employees

Step 6: Investment & Turnover Declaration

Provide information about investments in plant/machinery and annual turnover.

Step 7: Submit Application

Tick the declaration box confirming accuracy, then click “Submit.” Enter the final OTP received on your mobile.

Step 8: Receive Certificate

Upon successful submission, you will receive an e-certificate with a unique Udyam Registration Number (URN) via email.

FAQs

Is Udyam Registration mandatory?

Yes, it is mandatory for all eligible MSMEs to register under Udyam since July 1, 2021.

What is the cost of Udyam Registration?

The registration process is completely free of charge.

How long does it take to get the certificate?

You will receive your e-certificate within 2–4 business days after completing the registration process.

Can I update my registration details later?

Yes, you can update your details anytime on the official portal.

Is GSTIN mandatory for Udyam Registration?

GSTIN is required only for businesses that must register under GST law.